Phase 2: Market & Firm Analysis

Phase 2 is the start of a thorough market and firm analysis. In phase 2 I identify the customers and segments, positioning and products, and examine the operational processes of the firm to make recommendations for improvement. Projects launched from these recommendations are often: 1) segmentation studies, 2) product satisfaction & usability studies, or 3) customer retention & engagement analyses. Much of this is done regularly in consumer packaged goods and other larger firms with higher levels of managerial sophistication. Bringing these frameworks together for software firms gives us an advantage over those firms that only loosely understand their customers and how to position themselves to their needs and provide the best products or services.

Phase 2 relies on classic marketing frameworks, “5Cs”, “STP”, and “4Ps” to provide scaffolding for the analysis and recommendations. The 5Cs are customer, context, competition, collaborators, and company. STP stands for segments, targeting, and positioning. The 4Ps, or marketing mix, are product, price, promotion, and place. Plenty has been written about these frameworks (Marketing Management (5e), Iacobucci, 2018) so I won’t go in-depth here but will talk about integrating them and my approach.

Exhibit 1: Visualization of phases.

Exhibit 1 shows my flow through these frameworks. Note that I start with the customer, move to segmentation and positioning, then to the products for those customer segments before examining the competition, context, collaborators, and company. The choice of customer and customer need is core to the success of a company; without knowing what value you’re providing to whom, the rest of the analysis is moot.

Customer

In my experience, many companies have either an ill-defined target customer or ill-defined understanding of their needs - often, it’s both. In the absence of these, identifying the target customer and unmet needs are the first projects that I kick-off. I work with the leadership team to articulate the key variables they believe make a good fit for their customer base. I then conduct a needs-finding study. This takes the form of jobs-to-be-done (JTBD) research. JTBD, or job theory, comes from the work of many innovation practitioners, most notably Clayton Christiansen.

While JTBD is relatively new to software companies, it is very similar to the goal-oriented interaction design practices first described by Alan Cooper, a thought leader in human-computer interaction, in his 1995 book About Face: The Essentials of Interaction Design, now in its fourth edition. This seminal work transformed how interaction designers approach problem-solving by starting with the user and unmet needs in the form of customer goals. Customers have tasks they do to accomplish those goals, and interaction designers look for ways to remove, reduce, or make those tasks easier. While examining the tasks is relevant to the product and design teams, from a business perspective we can use the jobs to help determine customer segments and opportunities to innovate or disrupt a market.

Segmentation, Targeting, & Positioning

In 2005 Tony Ulwick published What Customers Want: Using Outcome-Driven Innovation to Create Breakthrough Products and Services, introducing outcome-driven innovation (ODI), which adds an additional level of analysis by looking at what customers are hiring a product or service for, how important it is to get that job done, and how satisfied with getting it done they are. His form of gap analysis provides a way of articulating user needs and the biggest opportunities to solve.

In order to surface key underserved target markets, firms can combine the top-down approach of identifying key attributes of customers the firm would like to serve with a cluster analysis on the results of a JTBD survey. The approach can also help redefine an industry. While at Electronic Arts, and later Raptr, I conducted a form of this research that helped re-segment the gaming population. Game companies identified certain customers as ‘hard-core gamers’, a group generally comprised of young men who play skills-intensive games, such as first-person shooters, real-time strategy games, or MMOs. However, that articulation failed to see similar behaviors and goals in casual games players, leaving out a huge untapped market. Identifying similar behaviors among different groups, including their need to be the best at the game by spending time on forums and reverse-engineering the game mechanics, led to the identification of a new gamer segment we called the ‘avid gamer’, which in turn led to rethinking how we targeted and positioned our products to those markets.

We can use these segments to determine the market size and select the most valuable groups for whom to create solutions. Because we know what the jobs customers are hiring a product for, we can use the language discovered through JTBD research to position our products. With these data we can formulate hypotheses: We can position our current product for new audiences, we can improve our current products to better meet the needs of our target customers and, if we want to innovate, we can look for new underserved needs with large enough markets for which to build products.

Product

Of the 4Ps of the marketing mix, I first focus on product, leaving price, promotion, and place for another time. The product is the solution to the target customer needs, and the other elements of the marketing mix will rely on market and economic research best tackled in partnership with other teams in the organization. Products and services are what we offer to serve the needs of the segments we are targeting. When I go through this analysis, I tend to start with relatively straightforward approaches to understanding the product, then dig in deeper to uncover areas for improvement and ensure accountable ownership of the product across the product and service teams. The goal is to determine what to measure and provide a baseline.

The first thing I look for is customer satisfaction (CSAT) measures to determine how well the product or service is meeting customer needs. There are many ways to determine CSAT, and I don’t intend to wade into the politics of satisfaction tools here. Any CSAT tool that provides a robust enough understanding of the customer’s perspective on your products or services is good. I combine the CSAT with a customer-only version of the JTBD analysis to get a sense of how well the product meets the needs of the targeted segments.

I also look at more qualitative measures, such as usability findings, to determine the key pain points in the product or service experience. There are many user research tools for this, and much is written about it, so I won’t go into depth here. As part of this research, I look at the competition component of the 5Cs to understand what direction competitors are taking their products or services and start to get a sense of their strategic approach.

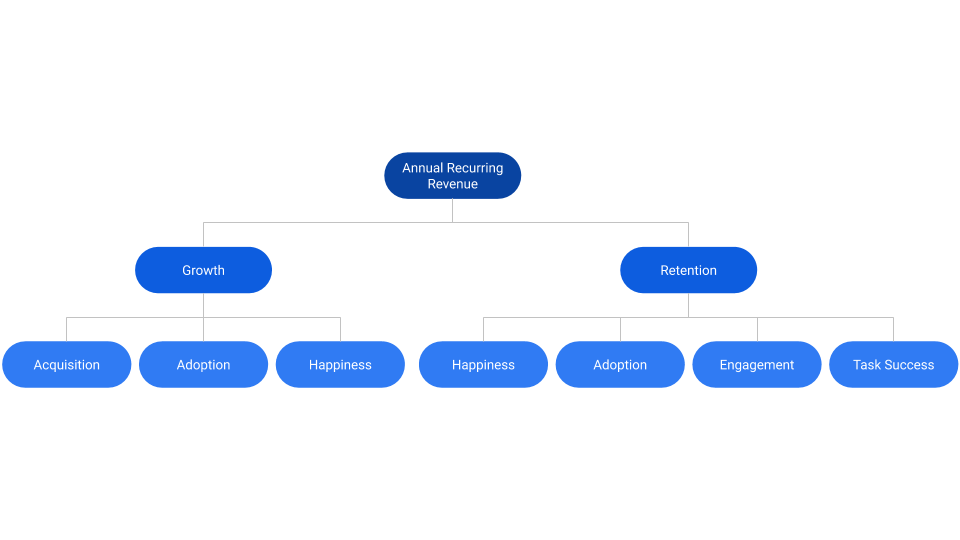

Finally, I work with data teams to identify key marketing, product, and service metrics, such as growth, engagement, retention, and feature adoption. Exhibit 2 shows an example of what types of metrics I look for in subscription-based companies with annual or monthly recurring revenue (ARR or MRR) as the core revenue metric. I’ve published a separate article on how to identify and use these metrics, drawing on the work of folks from Google and the Venture Capital community. I use this opportunity to identify the key marketing funnel metrics because I consider these all part of the product measurement process. The number of customers that make it from the marketing material into the product experience and become retained customers is an indication of product-market fit as well as effective targeting and positioning.

Exhibit 2: Cascading Metrics

The result of phase 2 is the information necessary to lead teams to identify short and medium-term marketing, product, and service improvements and is often enough to fill product and marketing roadmaps for a year or more. At this point I work with teams to identify five possible areas for product roadmaps: 1) Quality of life improvements, 2) feature enhancements, 3) new product features, 4) new products, or 5) new business opportunities. At this stage, I use data collected from customer, market, and product research to provide recommendations for quality of life improvements, feature enhancements, and new product features, but leave new products and businesses for after phase 3.

Company

While the research efforts for the market and product are underway, I begin an analysis of the company. At this point, I assess the current practices and identify any opportunities for minor improvements; I will spend more time on operations and leadership later in the Bringing It All Together section. Exhibit 3 shows a business maturity model developed by Jeff Cobb and Celisa Steele of Tagoras that I consult to give a rough idea of the maturity of a business's leadership, culture, strategy, capacity, portfolio, and marketing practices. While every business has its own needs and approach to implementing, these elements serve as a guidepost for what mature practices look like to set expectations across the operating teams.

Exhibit 3: Business Maturity model

In phase 2, I also review basic financial information for the firm to get a picture of the health of the business and urgency for transformation. Revenue, growth, and runway are important to review. I look at the percentages of revenue for headcount for each division to get a sense of where the company invests. A software company may want to invest heavily in engineering, but those are expensive resources and overzealous investment can lead to spending the firm out of business instead of focusing resources on scope appropriate team sizes.

SECTIONS IN THIS CHAPTER

Phase 2: Market & firm analysis

References

Iacobucci, D. (2014). Marketing management. Cengage Learning.

Christensen, C., & Raynor, M. (2013). The innovator's solution: Creating and sustaining successful growth. Harvard Business Review Press.

Cooper, A., Reimann, R., & Cronin, D. (2007). About face 3: the essentials of interaction design. John Wiley & Sons.

Ulwick, A. (2005). What customers want. McGraw-Hill Professional Publishing.

Cobb, J. & Steele, C. Learning Business Maturity Model. https://www.tagoras.com/maturity-model/