Chapter 1: Gathering the Inputs

I believe evidence-based, values-driven leadership is the key to unlocking the potential of great individuals, teams, organizations, and companies. I take a scientific approach to lead companies through stage-appropriate corporate and product strategy and process development and implementation to drive business impact, customer satisfaction, product quality, and employee engagement. I have experience across organizations in a variety of industries (including Advertising, Productivity, Education, & Video Games) and sizes (U.S. Navy, Google, & Electronic Arts to Coursera, Raptr, and my own startups). I have helped shape the direction of products that touch hundreds of millions of lives. At Electronic Arts and Raptr, I helped redefine the game industry’s understanding of their market segments; at Google, I helped reposition a product for a new market, launch the first-ever redesign of Google Adwords, and improve Google Docs and Presentations for students; at Coursera, I helped define the market segments for online education.

Emerging startups and industry behemoths often find themselves in need of a reset: from understanding their customers and industry landscape to determining the right product fit and operational models. While there is no one size fits all process or strategy for every size and stage of a company, over the last few decades I have gathered a set of evidence-based frameworks for focusing on the right customers and markets, products and processes, and goals and key results.

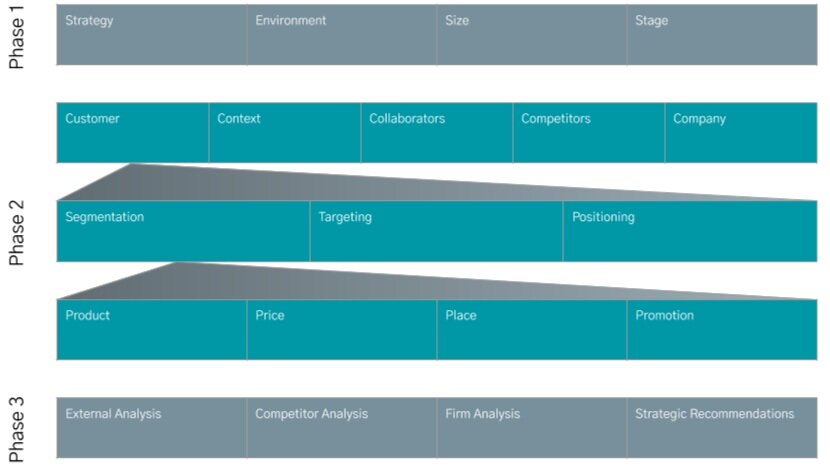

While I regularly add new frameworks to my toolkit, I generally take a three-phase approach, each with increasing levels of depth:

Phase 1 - Overview: Assessment of the organization’s internal and external situation

Phase 2 - Market & Firm Analysis: Detailed analysis of customers, products, and operations to kick off any needed detailed analysis such as market segmentation

Phase 3 - Strategic Analysis & Planning: Deep strategic analysis and planning across organizations and business units to build prepared minds capable of making tough decisions in the face of uncertainty

Exhibit 1: Three phases of business analysis

Exhibit 1 visualizes the flow through the phases. Along with the three phases of analysis, I combine design thinking, leadership, and organizational design and change management tools to lead teams to create and execute a strategy for accomplishing their mission. I describe my approach in the Bringing It All Together section.

Phase 1: Operational and Strategic Overview

Phase 1 starts with a 30-60-90 day plan that kicks off with an assessment. I’ll cover the 60 and 90 components in another writing - the short of it is 30: analyze, 60: plan, 90: implement and get quick wins. In the first 30 days, I assess the strategy, environment, size, and stage (SESS) of a company and review business practice maturity. The SESS framework is a variation of the organizational design work of Burton & Obel (1). As most of us have experienced, there is no single way to organize a firm or group; the organizational structure is contingent upon internal and external factors. The SESS framework helps us get a rough idea of how to think about what types of structures might make sense. The organizational details are the work the leadership team must go through to ensure their team is set up for success.

SESS

To keep things simple, SESS is a binary selection model (table 1); faster but less thorough than the market analysis of phase 2 (exhibit 1).

Table 1: SESS Framework

| Strategy | Environment | Size | Stage |

| Innovation | Dynamic | Small | Old |

| Efficiency | Safe, stable | Large | New, recent change |

Strategy

The first element to review to determine organizational structure is the firm’s strategy. A firm is often employing one of two strategic approaches: innovating (e.g. VR, AR) or finding efficiencies/replicating successes (e.g. film, games). If a firm has enough resources, they may be in both: old business units are the cash drivers for new innovation units. The game industry is a great example of this: a company like Electronic Arts can be making games for the current platforms while exploring new platforms and pushing the envelope with new approaches to games. Some will work, some will fail, but their primary game classes continue to drive revenue for these innovation efforts. Companies that are innovating are looking for ways to increase value to customers. On the other hand, as an industry, business, or product matures, firms often focus on efficiency to reduce costs and maintain profits.

A company may move between innovation and efficiency over time. A company that is maintaining a mature product while looking for innovation opportunities would be considered to have an innovation strategy because that is the focus of future plans.

Environment

The type of strategy that may best suit a company is informed by the market and industry environment they are operating within. Less mature industries or markets may be more dynamic, with more firms competing fiercely for market share. A more mature industry may be considered more safe or stable (e.g. Taxis, airport ride-sharing); however, this sense of safety can come with its own drawbacks. Mature industries are regularly disrupted by new technologies, market dynamics, or innovative business models (e.g. Uber, Lyft).

Size

Firm or organization size is important to consider because it can have an impact on expenses, competitiveness, and operational flexibility. I think about size relative to a firm's primary competition. If most companies in an industry or market have 200 employees and you have 100, I would consider you small. But if your competitors have 30 employees and you have 200, you are a large firm. This helps avoid assuming only huge companies are large (e.g. HP with over 330k employees), when I have experienced companies of 200 that I definitely consider large.

Size impacts the organizational structure because the more employees a firm has, the more cooperation they need between units to reduce cost burdens and stay aligned on strategy. This usually entails hiring more management but can be accomplished through other means, such as communication software or high levels of employee transparency. The organization of the executive team is impacted by the firm size as well; if the firm is very large, with multiple business units, they are likely to need more people to lead business units and have authority and responsibility for revenue and expenses.

Stage

Size and stage often, but not always, go hand-in-hand. For example, HP was founded in 1939, so is old, and happens to be huge. The project management company Basecamp was founded in 1999 and has 50 employees. I would consider both old; however, HP restructured in 2004, at which point it could be considered younger because of any changes to operations that were rolled out as part of the restructuring. Interestingly, this means they may need more structure because there need to be more integrations in place to make up for the new inefficiencies from the sudden change and help everyone stay aligned. Basecamp is old as well, and while they make some minor changes to strategic approach over time, they remain largely the same as they have been for years because the structure works for their strategy, environment, size, and stage. Their level of structure works for their stage - everyone knows what everyone is doing, and they

Using SESS

With the SESS model, I get a sense of what kind of behaviors, operations, and structure I expect to see in a company. Structure doesn’t necessarily mean more layers of management. It can mean more integrative functions such as project managers or more specialized roles in business units. Smaller innovation-focused organizations in dynamic environments may need less structure in the form of integration activities. They may have less mature operations in the form of planning and forecasting because the organization likely operates with fewer resources and less data, needs to be flexible and creative, and communication is easier. Large efficiency-seeking companies in stable markets usually need more structure to control expenses and make the most of existing resources and capabilities. Their markets are more stable and determining demand for iterative products can be easier, making forecasting and yearly planning more straightforward.

In the case of older organizations, I expect to see more structure; however, if the firm wants to innovate, reducing structure in certain ways can loosen up controls, increase creativity and flexibility, and lead to innovation. An older, larger firm may want to push for less structure to enable innovation, even though it may be less efficient. Table 2 adds the structure assessment to the original SESS framework.

Phase 1 provides an overview of a firm and the environment it operates in. It serves as a handy way to estimate the operational and strategic needs of a company and can be helpful in getting a rough idea of what to focus on in the next phase: a more thorough market and firm analysis.

Table 2: Possible structure direction relative to SESS assessment

| Strategy | Environment | Size | Stage | Structural consideration |

| Innovation | Dynamic | Small | Old | Less |

| Efficiency | Safe, stable | Large | New, recent change | More |

It is important to note that while a firm may be very large, they may operate in a way that gives them the agility of a small firm. If that’s the case, it’s fine to consider them a small size or new stage firm. The opposite can also be true: an older, small firm may suffer from unnecessary bureaucracy and outdated processes designed for when the firm was brand new that no longer serves the business needs. Table 3 provides a few examples of the framework in action:

Table 3: Example companies in the SESS framework

| Firm | Strategy | Environment | Size | Stage | Structure |

|---|---|---|---|---|---|

| IDEO | Efficiency | Dynamic | Large | Old | Medium |

| Intel | Efficiency | Safe, stable | Large | Old | More |

| Google (not including X) | Efficiency | Stable | Large | New | More |

| Microsoft (Azure biz) | Innovation | Dynamic | Large | New | Medium |

IDEO: As a large, older firm, IDEO likely looks to reduce costs while maximizing value in a dynamic environment. They could add less structure to find opportunities to innovate, and I expect they do in various business areas.

Intel: As a larger, older firm, Intel looks to reduce costs while maximizing value in a relatively stable, safe environment. They would want more structure to ensure cost efficiencies. They may look for opportunities to reduce structure in some business units to spark business model, operations, or product innovation.

Google Search Business: As a larger, older firm, Intel looks to reduce costs while maximizing value in a relatively stable, safe environment. They are more likely optimizing for efficiency than reworking their business model. Google Cloud may look more like Microsoft’s Azure Business.

Microsoft Azure Business: A newer, relatively small business unit in a dynamic environment, the Azure business likely has an innovation strategy to find the right business model, operational practices, and product offerings. They need specialists tightly integrated, but may want less hierarchical overhead to increase collaboration and reduce silos.

SECTIONS in this CHAPTER

Intro & Phase 1: Operational and strategic overview

References

Burton, R. M., & Obel, B. (2004). Strategic organizational diagnosis and design: The dynamics of fit (Vol. 4). Springer Science & Business Media.